When your application or website caters to a global audience, incorporating a feature that understands and adapts to different currencies isn’t just a convenience—it’s a necessity. This is where currency conversion APIs become invaluable.

A currency conversion API, specifically, is a service that offers real-time currency data, which can be used to convert amounts from one currency to another with up-to-the-minute accuracy.

Imagine you’re a developer working on an ecommerce store that serves customers across continents. Without real-time currency conversion, users may see prices that are outdated by the time they check out, leading to frustration and a loss of trust. This is why having access to live currency data through an API can make or break the international user experience.

This guide is designed to give developers like you the knowledge to not only choose the right API for your needs but to understand the intricacies of implementing one effectively.

Why do businesses need a robust currency API?

As a developer, if your client is aiming to internationalize their ecommerce store, implementing a currency conversion API such as Currency API is a pivotal step towards achieving a truly global reach.

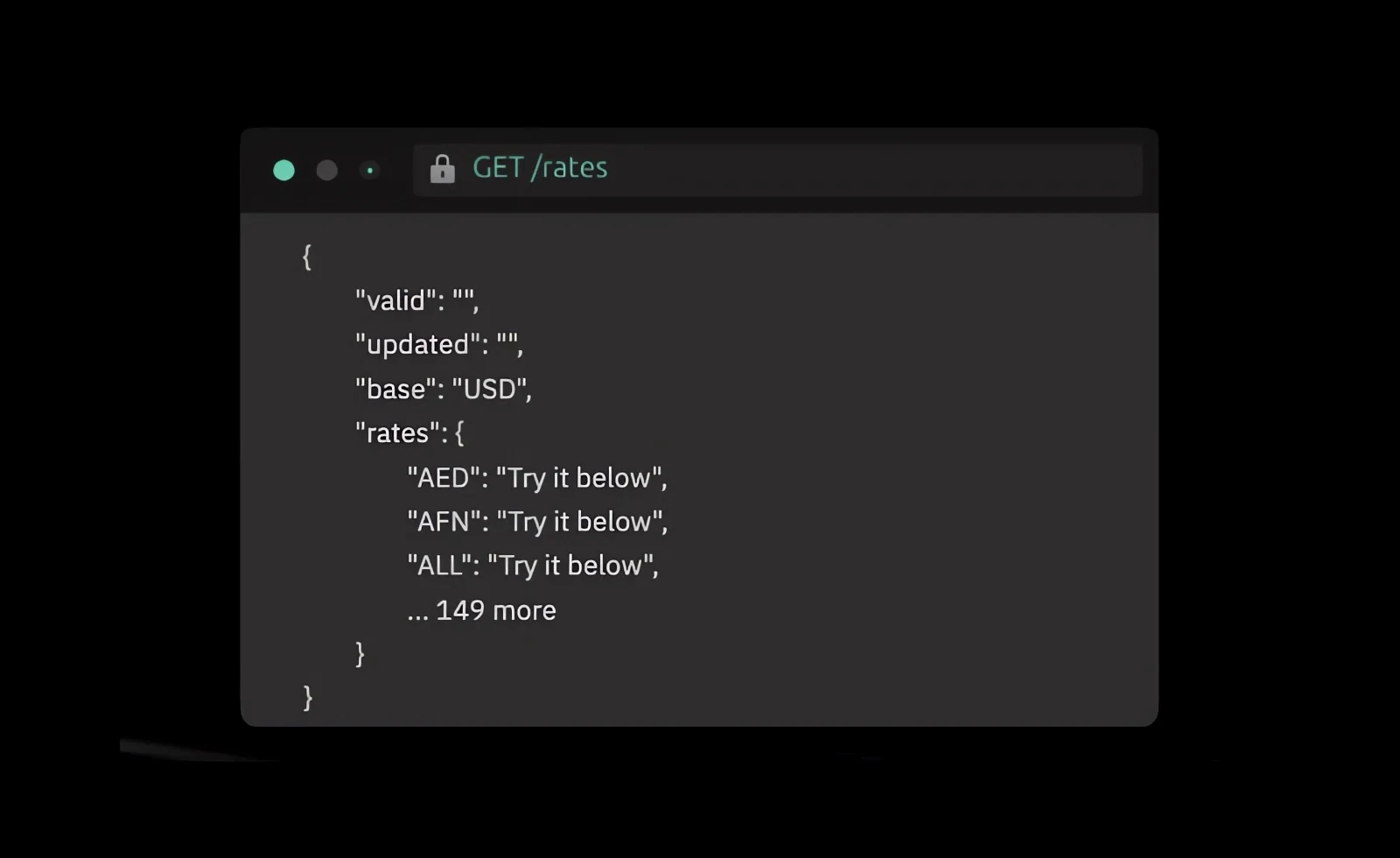

The Currency API effortlessly calculates currency exchanges in real-time, tapping into a diverse pool of financial resources that include:

- Over 152 fiat currencies

- Various cryptocurrencies

- Precious metals like gold and silver

Take a moment to picture a customer from Spain browsing your ecommerce store. They find a product they love and are ready to make a purchase. With a robust Currency API integrated into your platform, they can instantly see the price in Euros, calculated at the most current exchange rate.

This clarity empowers your customers to make informed purchasing decisions with confidence. The beauty of such technology? It’s seamless, it’s efficient, and it bridges the gap between your products and the global market.

What should I look for in a currency conversion API?

From the developer’s viewpoint, a good currency conversion API should allow for seamless integration into existing systems. This means it should provide clear, concise documentation and sample code for common programming languages. Additionally, it should offer flexibility in terms of features like setting a base currency, choosing the frequency of updates, and selecting specific currencies for conversion.

Developers also need to consider the API’s scalability. As the application grows, the API should be able to handle increased requests without performance degradation. Some of the features to look for are:

- Real-Time Data: A top-notch currency conversion API delivers exchange rates as they are updated in the global markets, ensuring users get the most accurate pricing available.

- Comprehensive Currency Coverage: It should cover a wide range of world currencies, including cryptocurrencies such as Bitcoin and Ethereum, offering flexibility and convenience for users regardless of their geographical location.

- Reliability: The API’s uptime is crucial; it should be dependable and consistently available, as downtime can result in lost revenue and a poor user experience.

- Security: Given that it deals with financial data, a secure API is non-negotiable. It should employ robust encryption methods to protect sensitive data in transit.

- Ease of Use: An API should be easy to integrate and use, with clear documentation and support, to ensure a smooth implementation process for developers.

Integration challenges and solutions

Developers often face issues like rate limits, timeout errors, and unexpected data formats. To tackle these, thoroughly review the API documentation to understand its constraints and plan your application’s architecture accordingly.

Additionally, ensure that your integration is designed to gracefully handle API errors, such as incorrect data inputs or server unavailability, to maintain a reliable user experience.

Overcoming Latency for Seamless Real-Time Applications:

- Optimizing API Calls: Latency can hamper the performance of real-time financial applications. Optimize the number of API calls using techniques like caching frequent requests, thus minimizing delays in data retrieval.

- Choosing the Right Provider: The geographical location of the API servers can affect latency. Choose an API provider with servers near your user base or with a good global distribution to reduce lag.

Upholding Security and Privacy in Transactions:

- Secure Data Transmission: To ensure the privacy and integrity of transaction data, employ APIs that utilize HTTPS for data transmission. This encrypts the data, safeguarding it from interception or tampering during transit.

- Compliance and Best Practices: Adhere to industry security standards and regulations, such as PCI DSS if handling conversions related to payments, to protect sensitive financial information. Regularly update your systems to mitigate vulnerabilities and maintain rigorous security measures.

Best practices in using currency conversion APIs

Ensuring Data Accuracy with Timely Updates:

- Scheduled Updates: Set up a schedule for regular data updates to maintain accuracy. Depending on your application’s needs, this could range from every few minutes to daily.

- Monitoring Exchange Rates: Use alert systems to monitor for significant fluctuations in exchange rates. This ensures that your application can respond quickly to market volatility, providing users with the most current data.

Optimizing Costs with Strategic Caching:

- Smart Caching: Implement caching mechanisms to store frequently requested data. This reduces the number of API calls needed, which can significantly cut costs and improve application performance.

- Caching Policies: Develop a caching policy that aligns with the volatility of currencies you’re dealing with. Highly volatile currencies may require shorter cache times, while more stable ones can be cached longer.

Robust Fallbacks for Uninterrupted Service:

- Redundant API Providers: Consider integrating with multiple currency conversion APIs. If one experiences downtime, your application can switch to an alternative to ensure continuous service.

- Local Backup Data: Keep a local backup of the most essential data. In case of API failure, your application can temporarily rely on this data until the service is restored.

- Downtime Notifications: Implement a system to notify your team of any API disruptions. Quick response times can mitigate the impact of any outages.

- User Communication: Have a protocol in place to inform users of any issues. Transparency builds trust, and users may be more forgiving if they’re made aware of the situation and the steps being taken to resolve it.

Monitoring and Analytics:

- API Usage Analytics: Monitor your API usage patterns to identify potential optimizations. Analytics can reveal opportunities to adjust your caching strategy or even renegotiate your API plan.

- Performance Metrics: Track performance metrics such as response time and accuracy. Consistent monitoring helps ensure that the API is meeting the expected standards and allows you to troubleshoot any issues proactively.

By adhering to these best practices, developers can create more resilient and efficient applications that leverage currency conversion APIs. Keeping data accurate, reducing costs, and preparing for potential failures are crucial steps in delivering a seamless experience to the end user.

We hope this guide serves as a valuable resource in your journey to integrate currency conversion APIs. By now, you should have a deeper understanding of their significance, how to integrate them seamlessly, and the best practices to follow for optimal performance and reliability.

For further references, you can checkout:

- API Marketplaces: Platforms like RapidAPI, and API List curate extensive lists of currency conversion APIs, allowing developers to compare features and find the best fit for their needs.

- Official Financial Institutions: Many financial institutions and currency exchange services offer their APIs. Check official bank websites and international financial service providers for APIs with robust data sets.

Related Posts:

- How to Make your Mobile App Run Smoothly – A Developer’s Guide

- Byte-sized Knowledge – A Beginner’s Guide to the World of Coding

- The Beginner’s Guide to Setting Up a Website: Step-by-Step Instructions

- Tailored Software Development: A Catalyst for Your Business Growth

- What to Consider when Choosing a Cloud Server Provider

- Ecommerce Fraud Prevention Software – Preventing Fraud on Your Store

- Revolutionizing B2B Ecommerce: Mobile Optimization Strategies for Success

- How eCommerce Businesses Can Take Advantage Of Technology

- The Benefits of Strategic Technology Consulting for eCommerce