Identity theft is an ever-growing concern. With a surge in online transactions, data breaches, and sophisticated cyberattacks, protecting one’s identity has become paramount. Recognizing this pressing need, TransUnion, a globally renowned credit reporting agency, introduced “True Identity.”

This service is designed to safeguard individuals from the looming threats of identity theft and fraud. In this guide, we’ll discuss the features and benefits of True Identity, shedding light on its significance in the modern world.

What is True Identity by TransUnion?

True Identity is a specialized service designed with the modern consumer in mind. At its core, it’s a protective mechanism, monitoring your credit reports and alerting you to any suspicious or unauthorized changes. The platform is part of TransUnion’s broader commitment to safeguarding consumers, offering a suite of tools and features tailored to the unique challenges of today’s digital landscape.

The primary goal of True Identity is straightforward yet vital: to help consumers protect themselves from identity theft and fraud. It achieves this by keeping a vigilant watch over your credit information, ensuring that any discrepancies or unexpected activities are brought to your attention promptly.

In essence, it acts as a digital sentinel, offering peace of mind in an increasingly interconnected world where personal data can be compromised in myriad ways.

By leveraging TransUnion’s vast expertise in credit monitoring and data protection, True Identity stands as a testament to the company’s dedication to ensuring that consumers have the tools they need to navigate the digital age securely.

Key Features of True Identity by TransUnion

1. Free Identity Protection

One of the standout features of True Identity is its commitment to providing essential protection services at no cost to the consumer. While many similar services might charge a premium, TransUnion understands the universal need for identity protection.

By offering free identity protection, True Identity ensures that everyone, regardless of their financial situation, can benefit from basic monitoring of their credit reports. This not only democratizes access to identity protection but also underscores TransUnion’s dedication to consumer welfare.

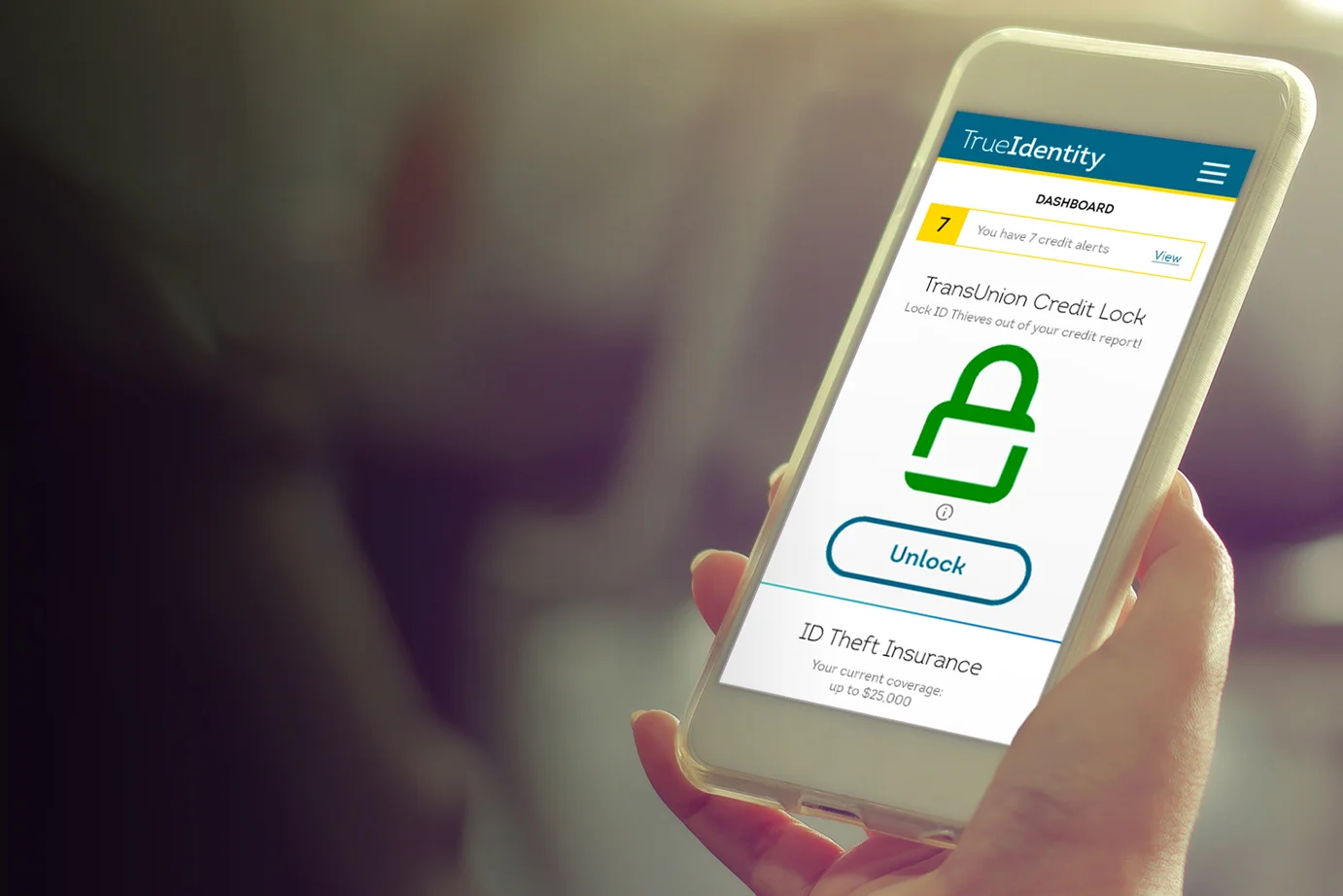

2. Credit Lock

Imagine having the ability to seal off your credit report with the click of a button, making it inaccessible to potential fraudsters. That’s precisely what the Credit Lock feature offers. Locking your TransUnion credit report means that potential creditors can’t access it.

This is a crucial tool in preventing unauthorized credit accounts from being opened in your name. In scenarios where identity thieves attempt to use stolen information, a locked report acts as a formidable barrier, ensuring that your credit remains untarnished.

3. Instant Alerts

Vigilance is the key to prevention. True Identity’s Instant Alert feature embodies this principle. Instead of discovering a breach after the damage has been done, users are immediately notified of significant changes or potential breaches in their credit report.

This proactive approach ensures that users can take swift action, whether it’s verifying a legitimate change or addressing a suspicious activity. In the fast-paced world of digital transactions, real-time alerts can make all the difference between preventing fraud and becoming its victim.

4. Safe Browsing Tool

While not every iteration of True Identity might offer this, when available, the Safe Browsing Tool adds an extra layer of protection. As users navigate the vast expanse of the internet, this tool provides warnings against potentially harmful sites that might be phishing for personal information or deploying malware.

It’s akin to having a digital bodyguard that guides users away from the darker alleys of the internet, ensuring safe and secure browsing.

5. Personalized Content

Financial situations vary from person to person. Recognizing this, True Identity offers content tailored to individual financial scenarios. Whether it’s advice on improving credit scores, understanding credit reports, or tips for safeguarding financial data, this personalized content ensures that users receive information relevant to their unique circumstances.

It’s not just about protection; it’s about empowering users with knowledge tailored to their specific needs.

Benefits of Using True Identity by TransUnion

1. Peace of Mind

In a world rife with stories of identity theft, cyberattacks, and data breaches, the psychological toll on individuals can be immense. Every ping from our devices can make us wonder: “Is that a legitimate notification or the start of a potential financial nightmare?” True Identity aims to alleviate such concerns.

By offering a robust set of tools designed specifically to protect one’s identity, it provides an invaluable peace of mind. Knowing that a trusted entity like TransUnion is diligently watching over your credit report allows you to go about your daily life with one less worry.

2. Early Detection

A stitch in time saves nine, and nowhere is this adage truer than in the realm of identity protection. True Identity’s vigilant monitoring ensures that any discrepancies or unauthorized activities are detected early on. This early detection is crucial.

Instead of grappling with the ramifications of prolonged unauthorized access, which could lead to significant financial losses or credit score damage, users can address potential threats at the outset. By catching these anomalies in their nascent stages, True Identity empowers users to nip potential issues in the bud, saving both time and money.

3. Automated Monitoring

In our busy lives, continuously checking credit reports or staying updated with the latest in cyber threats is a task easier said than done. This is where the convenience of True Identity’s automated monitoring shines.

Instead of manual checks or sporadic reviews, the service consistently watches over your credit data, operating silently in the background. Should anything unusual arise, it doesn’t go unnoticed. The platform instantly alerts users, ensuring they are always in the loop without the constant need for manual oversight. It’s like having a personal financial watchdog, tirelessly working 24/7 on your behalf.

Comparing True Identity with Other Services

The market for identity protection services is expansive, with numerous players offering a wide range of features. Among the frontrunners are major credit reporting agencies, as well as independent providers specializing in identity theft prevention. Let’s delve into how True Identity by TransUnion stacks up against these services.

Comparison with Other Major Credit Reporting Agencies:

- Equifax and Experian, alongside TransUnion, form the trio of major credit reporting agencies in the U.S. Each offers its own version of identity protection. Equifax’s ID Patrol and Experian’s IdentityWorks, for instance, provide features similar to True Identity, such as credit monitoring and instant alerts. However, where True Identity distinguishes itself is in its offer of free basic protection, making it accessible to a broader user base.

- Beyond the big three, there are other credit bureaus globally that might offer their versions of identity protection. The features and costs can vary significantly based on regions and specific consumer needs.

Comparison with Independent Providers:

- Companies like LifeLock and Identity Guard are specialized providers focusing solely on identity protection. These services often come with a broader suite of features, encompassing not just credit monitoring but also recovery services, insurance, and more. While these might offer a more comprehensive package, they often come at a premium cost compared to True Identity’s free basic service.

Advantages of True Identity:

- Cost-Effective: One of the standout benefits is the free basic protection, ensuring that a wide array of consumers can benefit without financial barriers.

- Backed by TransUnion: Being powered by one of the major credit reporting agencies, True Identity boasts a wealth of expertise and a long-standing reputation in the credit monitoring domain.

- User-Friendly Interface: With a focus on simplicity and ease of use, users can effortlessly navigate their credit information and alerts.

Potential Disadvantages:

- Limited Scope in Free Version: While the basic protection is free, some advanced features available in competitor services might only be accessible in True Identity’s premium versions.

- Focused Mainly on Credit Monitoring: Some specialized providers offer more holistic identity protection, covering aspects beyond just credit monitoring.

In essence, while True Identity offers a robust set of tools for credit monitoring and identity protection, especially at the basic free tier, users seeking a more comprehensive suite might need to explore premium versions or other specialized providers.

Wrapping up:

Our personal and financial data, once compromised, can lead to a cascade of challenges, from financial losses to the arduous task of restoring one’s credit reputation. The importance of being proactive, therefore, cannot be overstated. By taking preemptive measures, individuals can shield themselves from the brunt of potential cyber threats, ensuring that their digital lives remain uncompromised.

True Identity by TransUnion emerges as a beacon in this space. By offering a suite of tools designed specifically for identity protection, it underscores the significance of vigilance. The free identity protection ensures that a broad spectrum of users can benefit from essential monitoring, while features like credit lock and instant alerts fortify the defenses against unauthorized activities.

Visit the official website of TransUnion to try this service.

- Fraud Prevention Software for Ecommerce and Account Takeover Fraud

- Scam Prevention Tips: How to Stay Safe Online

- Mobile Payment Security: Ensuring Safe Transactions in Apps

- Fixing Mobile Banking: How to Deal with Security Issues

- 8 Reasons For Companies To Hire a Cybersecurity Professional

- Preventing Data Loss: Secure FTP Ensures Data Integrity and Confidentiality

- Cyber Self-Defense – Understanding and Protecting Your Data Online